The finance field is a critical component of the global economy, encompassing a wide range of services and institutions that manage money, investments, and assets. As financial markets continue to evolve, numerous companies have emerged, each serving distinct roles within this dynamic landscape. This article explores the various companies in the finance field, from banks and investment firms to fintech startups, and highlights their importance in shaping the financial ecosystem.

Understanding the Finance Field

Before diving into specific companies, it’s essential to grasp the broad categories within the finance field. The finance sector can be divided into several segments, including

Banking

This includes retail banks, commercial banks, and investment banks.

Investment Management

Firms that manage investments on behalf of clients, including mutual funds and hedge funds.

Insurance

Companies that provide risk management and protection services.

Fintech

Technology-driven firms offering financial services through innovative platforms.

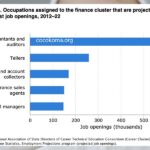

Accounting and Tax Services

Firms that provide financial reporting, tax preparation, and consulting.

Private Equity and Venture Capital

Companies that invest directly in private companies or startups.

Understanding these categories is crucial for recognizing the key players in each segment and their respective contributions to the finance industry.

Major Types of Companies in the Finance Field

Banks

Banks are the backbone of the finance industry, providing essential services such as deposit accounts, loans, and credit. The banking sector is divided into various categories:

Retail Banks

These banks cater to individual consumers and small businesses. They offer services like savings accounts, mortgages, and personal loans. Notable examples include JPMorgan Chase, Bank of America, and Wells Fargo.

Commercial Banks

Focused on businesses, commercial banks provide services such as business loans, asset management, and treasury management. Citigroup and HSBC are prominent players in this sector.

Investment Banks

These banks assist corporations and governments in raising capital through securities offerings, mergers, and acquisitions. Goldman Sachs and Morgan Stanley are two of the most recognized investment banks globally.

Investment Management Firms

Investment management firms play a crucial role in managing assets for individuals and institutions. They create portfolios that align with clients’ investment goals and risk tolerance. Key players in this sector include:

BlackRock

As one of the largest asset management firms globally, BlackRock manages trillions in assets and provides investment solutions across various asset classes.

Vanguard

Known for its index funds and ETFs, Vanguard emphasizes low-cost investing and is a favorite among individual investors.

Fidelity Investments

This firm offers a broad range of investment services, including mutual funds, brokerage services, and retirement planning.

Insurance Companies

Insurance companies provide risk management solutions by pooling resources to cover potential losses. The major types of insurance companies include:

Life Insurance Companies

Firms like MetLife and Prudential offer life insurance products that provide financial security to beneficiaries upon the policyholder’s death.

Property and Casualty Insurance

Companies such as State Farm and Allstate offer coverage for property damage and liability protection.

Health Insurance

Firms like UnitedHealthcare and Aetna provide health insurance plans, covering medical expenses for individuals and families.

Fintech Companies

Fintech companies have transformed the finance field by leveraging technology to provide innovative financial solutions. Some notable fintech players include

PayPal

A pioneer in online payment solutions, PayPal allows individuals and businesses to make and receive payments over the internet seamlessly.

Square

Known for its point-of-sale systems, Square provides payment processing services and small business financing solutions.

Robinhood

This trading platform has popularized commission-free stock trading, appealing particularly to younger investors.

Accounting and Tax Services

Accounting firms play a vital role in ensuring compliance with financial regulations and helping businesses manage their finances. Leading firms in this sector include.

Deloitte

One of the “Big Four” accounting firms, Deloitte provides auditing, tax, and consulting services to clients worldwide.

PricewaterhouseCoopers (PwC)

PwC offers a range of financial services, including audit and assurance, consulting, and tax advisory.

Ernst & Young (EY)

Another member of the “Big Four,” EY focuses on helping businesses improve their financial performance and navigate regulatory complexities.

Private Equity and Venture Capital Firms

Private equity and venture capital firms provide capital to companies in exchange for equity stakes, often driving innovation and growth. Key players include

The Carlyle Group

A global investment firm specializing in private equity, real estate, and investment management.

Blackstone Group

One of the largest private equity firms in the world, Blackstone manages investments across various asset classes.

Sequoia Capital

A prominent venture capital firm known for investing in early-stage technology companies, Sequoia has backed several successful startups.

The Importance of Companies in the Finance Field

The finance field plays a crucial role in economic growth and stability. Here are several reasons why companies in this sector are significant

Facilitating Capital Flow

Financial companies facilitate the movement of capital within the economy, enabling businesses to access funds for growth, innovation, and expansion. Without banks, investment firms, and other financial institutions, it would be challenging for companies to secure the necessary resources to thrive.

Risk Management

Insurance companies play a vital role in mitigating risk for individuals and businesses. By providing coverage for unexpected events, they promote financial stability and confidence in economic activities.

Investment Opportunities

Investment management firms and fintech platforms offer a wide array of investment opportunities for individuals and institutions. By managing portfolios and providing access to financial markets, these companies empower investors to grow their wealth.

Economic Stability

A robust finance sector contributes to overall economic stability. Through effective regulation and oversight, financial companies help maintain trust in the system, ensuring that funds are allocated efficiently and that risks are managed appropriately.

Innovation and Technology Advancement

The rise of fintech has driven innovation in financial services, creating new products and platforms that enhance accessibility and efficiency. Companies in this space are continually pushing boundaries, improving user experiences, and revolutionizing traditional finance.

Future Trends in the Finance Field

The finance field is constantly evolving, influenced by technological advancements, regulatory changes, and shifting consumer preferences. Here are some trends to watch for in the coming years

Increased Regulation

As the finance sector grows, so does the need for effective regulation. Governments and regulatory bodies will continue to focus on consumer protection, financial stability, and the prevention of fraud.

Digital Transformation

The digital transformation of financial services will accelerate, with companies investing in technology to improve operational efficiency and enhance customer experiences. AI, blockchain, and big data analytics will play significant roles in shaping this transformation.

Sustainable Finance

There is a growing emphasis on sustainability in finance, with companies increasingly considering environmental, social, and governance (ESG) factors in their investment decisions. This trend will likely continue as investors and consumers demand more responsible financial practices.

Rise of Decentralized Finance (DeFi)

DeFi platforms, which leverage blockchain technology to offer financial services without traditional intermediaries, are gaining popularity. This trend may disrupt traditional finance models and create new opportunities for investors.

Focus on Cybersecurity

As financial services become more digital, the threat of cyberattacks increases. Companies in the finance field will need to prioritize cybersecurity measures to protect sensitive customer information and maintain trust.

Conclusion

The finance field encompasses a diverse array of companies, each playing a vital role in managing money, investments, and risks. From traditional banks and investment firms to innovative fintech startups and insurance providers, these companies are essential to the functioning of the global economy. Understanding the various players in the finance sector helps individuals and businesses navigate their financial needs effectively. As the industry continues to evolve, staying informed about trends and developments will be crucial for success in this dynamic environment.

By exploring what companies are in the finance field, we gain insight into the essential services they provide and their impact on our daily lives. The finance industry is not just about numbers; it’s about facilitating growth, managing risks, and fostering economic stability for a better future.